A quick little thought…

One of the critiques of the speculative investment activity in the crypto space is that there is little correlation between the dollars being invested and the actual volume of use of the products.

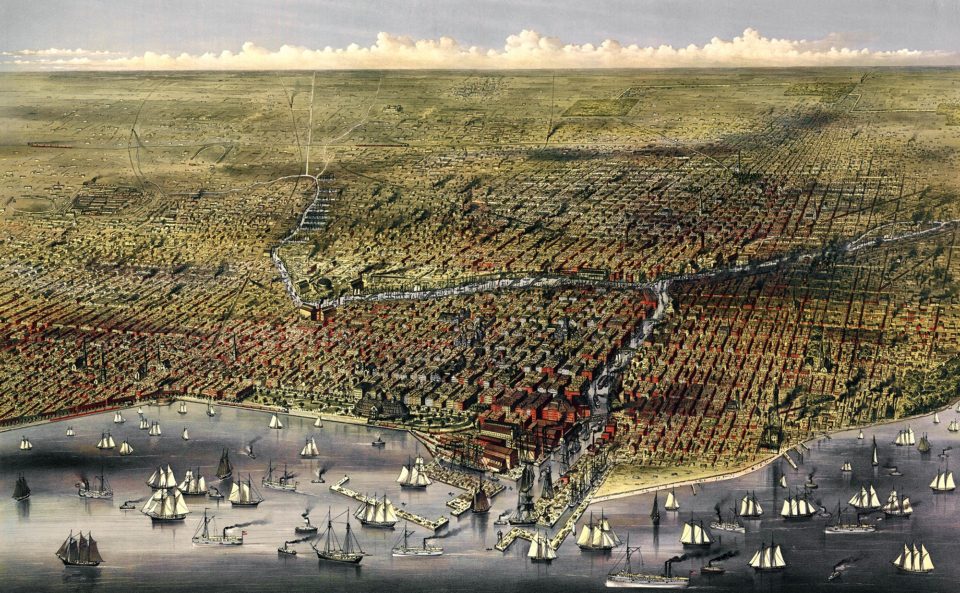

There are plenty of good counters to that argument. One is simply “Hi friend, meet Speculation. It has proceeded every industry, like, ever. Like, Chicago and Saint Louis had money pouring into them as boosters tried to speculate on which would be the dominant inland economic hub and it had nothing to do with current value. So, you know, deal with it.”

The second is actually more interesting to me in the context of the single biggest mistake I think we have in how we view and discuss blockchain projects, which is that we speak of them as though they were for-profit companies, rather than entire economies.

I mentioned this in a piece about Airdrops earlier this week and referenced the best discussion I’ve heard of this topic so far, which is Eyal Hertzog speaking with Kevin Rose on Block Zero (start at about 0:37 for this topic, but grab a coffee, take a seat, listen to the whole thing, and send me some ETH thanking me for telling you you should).

The short of it is that for-profit companies seek to maximize revenue and ultimately profit, while economies seek to maximize the volume and quality of exchange between members. When we pour currency into a community of people with some shared interest, we create an economy.

The interesting thing is that because they are fundamentally communities with a means of exchange, crypto economies actually take on a life of their own that is separate, to some extent, from the maturation of the company underlying the project. These economies can, in their volume of activity, interest, engagement and exchange, be robust – even when the companies supporting them are still very nascent and growing. These economies ultimately need the companies to provide whatever core infrastructure, technology, business support, etc they’ve promised and designed into their system, but in the same way the health of the American economy is based on a lot more than the health of the government, crypto economies are not (only) a reflection of the company behind them.

When you take this view, an investment in a cryptocurrency isn’t only an investment in the product of the company, it’s an investment in the community driving the economy that surrounds it.

Comments are closed